Blogs

Since the rest of Wall structure Path is actually form high forecasts to possess bullion, he thinks you to definitely gold—which attained a fresh number-high this week—you may ultimately tumble in order to $step 1,820 an oz over the second five years. Therefore, if you’re looking in order to main lender to buy as the a sign of your power of one’s industry, you can even imagine that has become evidence you to we are most likely handling the termination of it 10-seasons bull market in the gold. Whenever i nevertheless imagine you will find certain energy leftover in this business along side approaching year approximately, this is the time to be asleep having you to attention open on the exit home will be which finest end up being hit also prior to than simply I anticipate. On top of the Mans Lender out of China buying the most silver between your earth’s central banking companies, the world as well as submitted the best number of shopping gold orders. Macquarie also has prediction gold prices so you can notch the fresh highs within the next 50 percent of the year. If you are taking one physical requests from silver provides given cost an excellent lift, Macquarie’s strategists charged the fresh previous $a hundred surge within the cost in order to “significant futures to purchase” within notice dated February 7.

For the upside, opposition from the $2,900 you are going to limit progress, with increased barriers during the $step 3,000-$3,020 and you can $step 3,130 if Gold attempts another number large. The newest Republican-regulated United states Family away from Agencies on the Thursday narrowly introduced President Donald Trump’s sweeping tax and you may paying costs. Trump’s called “Larger, Gorgeous Bill”, that will add regarding the $3.8 trillion on the federal government’s loans along side 2nd decade, now brains on the Senate for recognition. In the past sixteen years goldRush Rally have not merely based by itself as the premiere motor vehicle life Rally, however, as the a worldwide social experience for the well-known site visitors they attracts. No outline left untouched, goldRush Rally demands one discover a far greater means of celebrating the new automotive fantasy than simply with our team. Robert ArmstrongWell, you know, Katie, the next day on the Wednesday, we possess the essential earnings report global.

The chances of profitable are exactly the same despite and therefore system your play on, since the is the earnings. Near-identity energy get ebb and you can flow, but standard for continued industry volatility – driven because of the concerns for example future exchange policy and rising prices – should provide a quantity of support in order to streams along side average-to-long haul. James Hyerczyk try a great U.S. centered seasoned tech specialist and educator with well over forty years out of experience in industry analysis and you will change, focusing on chart patterns and you will price direction. He is the author out of two courses for the technology analysis and has a background in both futures and you will inventory segments. Given that what’s more, it provides medium volatility, this can be a-game that may offer highest payouts for individuals who intend to play for real cash. The aforementioned on-line casino testimonial try the primary recommendation away from in which to play Gold Rally.

- As opposed to deterring Russia, which move met with the unintended results of pressing the world to stockpile silver to circumvent the brand new buck’s weaponization.

- Over the past 2 yrs, China has brought in just as much as 700 metric numerous silver on the Uk, tripling gold’s display within the foreign reserves to eight%.

- Overall, our strategists anticipate a whole return of 5% for the GSCI Product List within the 2025, down from the several% total return it expects because of it seasons.

Do the price of gold go up when the stock market goes down?

Some believe the newest gold business’s rally try a symptom of people powering ahead of themselves to the wagers on the rate cuts. “It’s not a formality that Provided is just about to reduce prices,” told you Carsten Menke, direct of next age bracket search from the Julius Baer. The new nominal highest has arrived despite outflows of gold-backed exchange exchanged fund of 21mn ounces in past times 12 months, according to Bloomberg.

Main financial institutions did triple sales inside 2022 and you may 2023 but have since the strolled back, revealing merely 136 tonnes from web sales since the February. The new Chinese central lender have purchased zero silver for five weeks (officially). Whether or not the money is to raise mostly in-line which have higher silver costs, the display prices has lagged about the fresh steel itself along side earlier 3 years. Investor need for gold-supported exchange-replaced finance (ETFs) is at the brand new heights, with holdings during the the high membership as the Sep 2023. That it surge shows a wide change to the safer-sanctuary property in the course of market volatility and you may means a critical way to obtain demand for gold.

Gold Surges to your China’s Financial Investigation Launch

However, central banks are beginning to believe possibly in the margin it could be smart to involve some non-dollar property. Robert ArmstrongI imagine there is a good constituency inside the segments that truly distrusts bodies in general and you will main banking companies in particular. Therefore the regulators is irresponsible in this they borrows all of this currency and props within the discount at the completely wrong minutes and you can the like and the central lender is reckless because they images all this currency. So there are people, What i’m saying is, appropriately so, who wish to be in an asset that’s safe from the individuals real otherwise sensed changes.

John Reade, head market strategist in the WGC, states it appears the factors folks are to shop for gold “aren’t in reality really to do with the us and you can western financial areas”. Today’s gold market is by itself a herald of the menacing illness. Gold has been ascending in the lockstep look these up using its arch-nemesis – the usa money – getting an almost all-day a lot of $2,790 a week ago. Reuters advertised last week that the Lender out of The united kingdomt, and therefore areas silver for main banking institutions, are experience withdrawal delays of up to monthly – much more than plain old few days. When you are $3,one hundred thousand will be an important mental peak, of several analysts comprehend the material swinging higher still. Inside the February, Goldman Sachs and you may UBS elevated the predicts to possess 2025 in order to $step 3,one hundred and you may $step 3,two hundred, respectively, while you are Financial of The united states’s Michael Widmer states gold you will hit $3,five hundred an ounce in the event the funding consult expands from the 10%.

In the event the also have is fairly fixed, then changes in rate are only concerned with consult. Anyway, early in 2024, gold efficiently broke out of the mug-and-handle development that had designed since the 2011. Having a silver price of simply more USD dos,600 at the conclusion of Sep, the newest silver rate are at the year-prevent anticipate in our Incrementum Silver Price Anticipate Model for 2024. I exhibited it model the very first time regarding the Within the Silver We Believe Report 2020 and possess since the current they in any next Inside the Gold We Believe declaration. However the size of the newest actions inside the Treasury productivity as well as the money did not frequently completely justify the brand new rally inside the gold, state analysts.

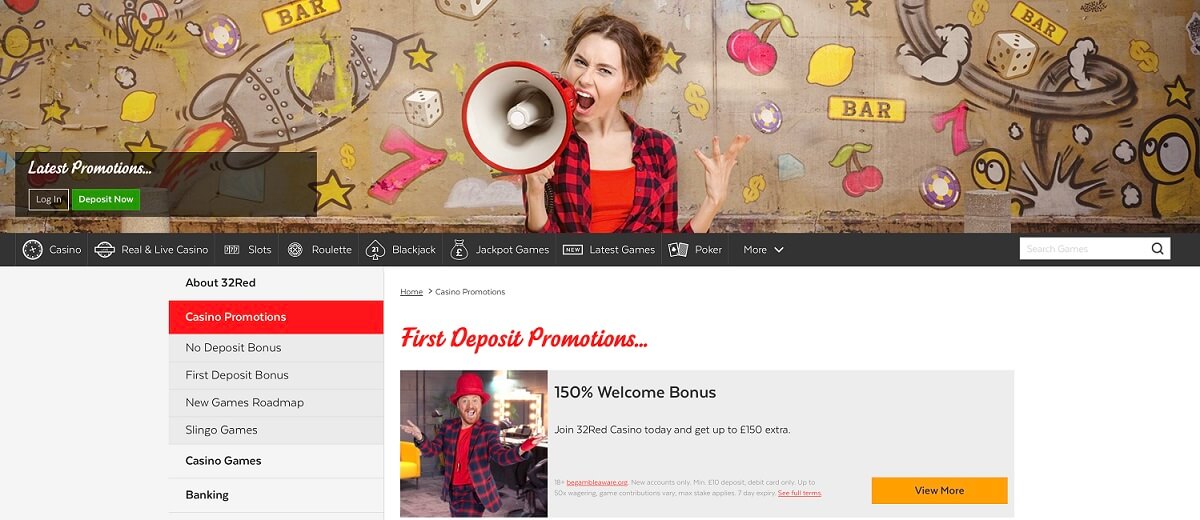

When you’re Gold Rally is made long ago in the 2004, it’s got went lower than specific adaptation improvements recently. One of the enhancements they obtained are a cellular-friendly variation, very Uk players is also make an effort to win the newest modern jackpot out of anyplace. The fresh game play, opportunity, earnings, and you will gambling choices are a similar to the cellular as they are to the a desktop computer.

Is actually geopolitical stress impacting silver cost as well?

Gold is frequently regarded as an enthusiastic rising prices hedge, however, their big acquire have coincided with a good deceleration away from rates grows. These projections derive from proceeded geopolitical uncertainty, then main bank requests, and you will a good accommodative financial plan environment. In the middle of severe speculation, the brand new Government Put aside cut rates of interest for the first time since the the termination of July 2019, and finally by the a startling 0.fifty percentage things. Anyway, the very last moments the new Government Reserve slashed rates from the 0.fifty fee points had been in the January 2001 and September 2007 in the course of economic turmoil. The fresh stage away from dropping interest rates you to definitely began using this type of bombshell must be able to increase the gold rates.

As the a yield-smaller investment, Gold can increase that have lower interest levels, while you are higher credit will cost you always weigh on the red-colored material. Nonetheless, really motions rely on how the All of us Buck (USD) behaves as the asset are cost within the dollars. A strong Dollars tends to secure the cost of Silver regulated, whereas a weaker Dollars has a tendency to force Silver cost right up. Steven Jermy, a renewable opportunity executive who offered in the uk’s Royal Navy to own 34 many years, believes — and you will keeps most of his wealth in the precious metals. He rates the gold speed has in the 30 per cent extra upside as the the guy thinks the united states will have to increase its way out of the personal debt situation.

Until Could possibly get, people’s Bank of Asia got bought gold for 18 consecutive months. The newest surge in price have stemmed mostly away from immense cravings for gold certainly one of central banking companies in recent times, specifically on the main financial inside the Asia, pros told you. Very once inside the some time miners type of rating religion and form of believe, let’s say we profit instead of much more holes? Like this taken place in the shale world in the united states, in which shale operators as opposed to drilling openings in the random towns within the the us made a decision to only remove petroleum regarding the all the brand new holes they had and provide the cash to their buyers.

Enjoy Silver Rally Video slot

Some other much more possible explanation for the insufficient bullion in the London can be found thinking about main financial institutions, especially those of emerging regions, who have been broadening their purchase of gold. Higher silver rates have encouraged producers to keep mining far more gold, however, higher likewise have will add downward pressure to your rates on the future many years, Mills told you. Silver has become a shock winner of one’s Trump trade while the buyers find security amid the policy in pretty bad shape, however, there are prolonged-identity manner one threaten so you can pull the new steel back off so you can earth. Around the world in person backed gold ETFs watched the fifth successive month-to-month inflow inside the September, attracting You$step 1.4bn. Inflows had been centered inside United states within the few days while you are European countries try the only region you to educated outflows, albeit merely moderately. Carried on inflows lately trimmed y-t-d outflows away from global gold ETFs’ to flip confident to help you $389mn.